Ifrs 9 Recycling

Activity timeline Impact assessment phase 2015 Build test deploy Training Stakeholder management Go-live 2016 2017 2018 Key activity Parallel Proving run Go live Board level project sponsorship and engagement Strong senior management ownership of the project setting clear objectives and deadlines. The IASB completed its project to replace IAS 39 in phases adding to the standard as it completed each phase.

Ifrs Webinar Series Transition To Ifrs 9 Youtube

The objective of the entitys.

Ifrs 9 recycling. QUESTION 1 - RECYCLING GAINS OR LOSSES ON DISPOSAL The Basis for Conclusions to IFRS 9 paragraph BC525b explains why IASB decided not to allow recycling when equity instruments are carried at FVOCI. Dibahas dalam rapat IASB bulan September 2015 Bila melihat niat DSAK untuk menjaga kesenjangan antara. For companies reporting under IFRS 9 restate profit loss performance metrics to include those fair value changes recognised in OCI.

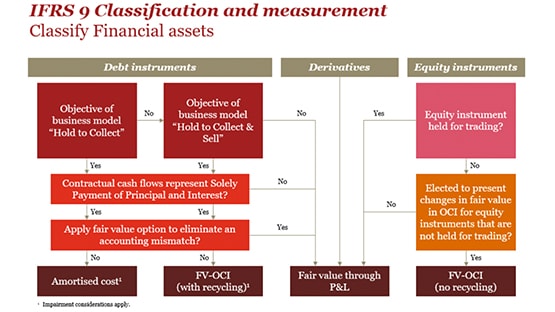

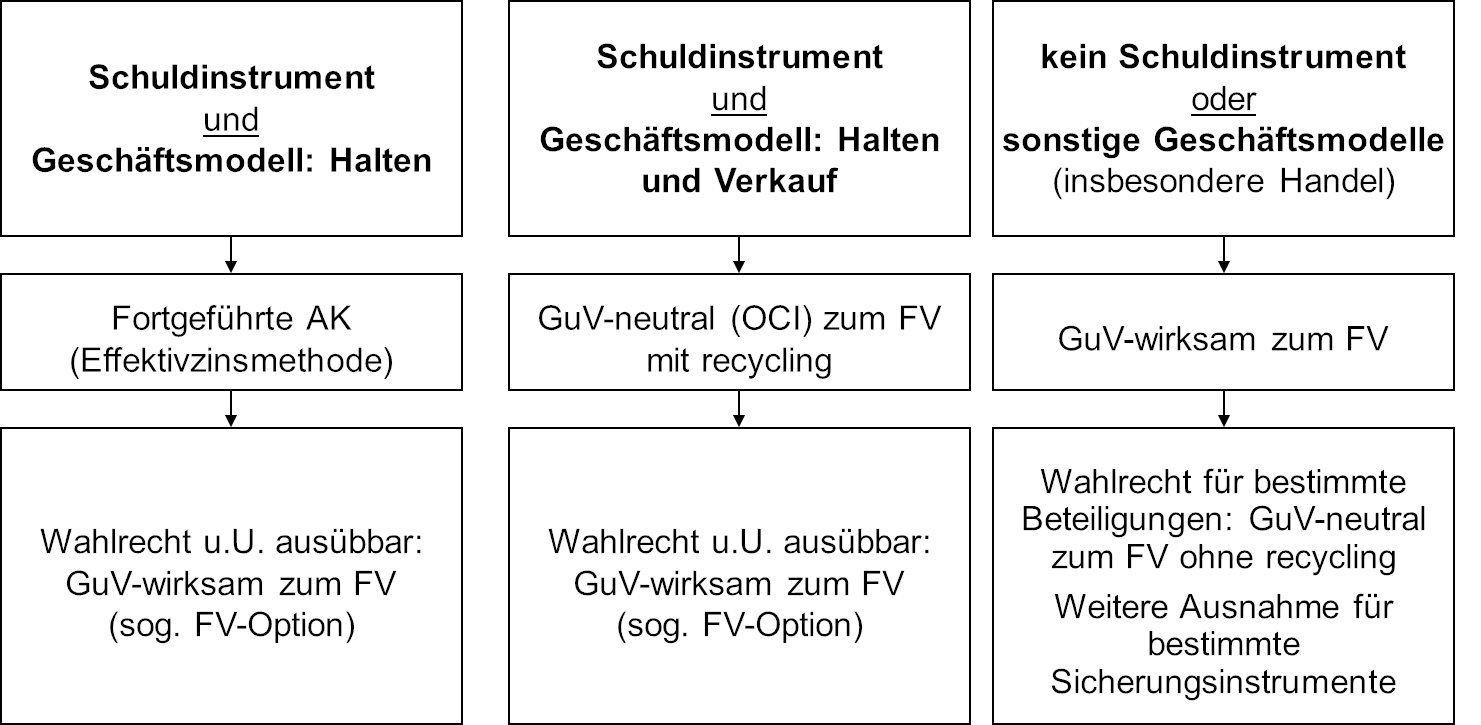

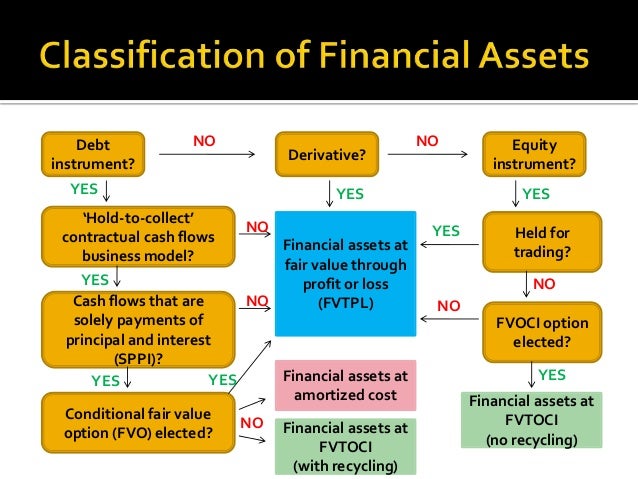

Debt instruments at amortised cost ii. IFRS 9 replaces the rules based model in IAS 39 with an approach which bases classification and measurement on the business model of an entity and on the cash flows associated with each financial asset. Assets measured at FVOCI no recycling are not subject to impairment requirements of IFRS 9 IFRS 9551.

IFRS 9 Financial Instruments issued on 24 July 2014 is the IASBs replacement of IAS 39 Financial Instruments. Recycling is basically the re-recognition of previously recognized gain. Answer 1 of 4.

Any financial instruments that are currently accounted for under IAS 39 will fall within the IFRS 9s scope. IFRS 9 also prohibits the recycling of the gains and losses on FVTOCI investments to SOPL on disposal. It can be assumed that a large portion of insurers fixed income assets are allocated to.

IFRS 9 Financial Instruments 7 IFRS 9. The no reclassification rule in both IAS 16 PPE and IFRS 9 means that such gains on those assets are only ever reported once in the statement of profit or loss and other comprehensive income ie are only included once in total comprehensive income. Remaining in other comprehensive income OCI ie without recycling The classification is based on both the entitys business model for managing the financial assets and the.

Financial assets designated at FVTPL. Cost as an estimate of fair value. Investment Implications How the accounting standard can affect the investment strategy of insurance companies Since its effective date on 01 January 2018 IFRS 9 has.

That is all you do in recycling. FVOCI without recycling of fair value changes to profit and loss. IFRS 9 has the following measurement categories in which financial assets are classified.

IFRS 9 generally has to be applied by all entities preparing their financial statements in accordance with IFRS and to all types of financial instruments within the scope of IAS 39 including derivatives. While some of the IAS 39 requirements can be trans- ferred almost identically into IFRS 9 regulation for example accounting of financial liabilities derecognition rules accounting of financial assets under IFRS 9. Recognition and MeasurementThe Standard includes requirements for recognition and measurement impairment derecognition and general hedge accounting.

Disclosure requirements relating to reclassification of financial assets are set out in paragraphs IFRS 712B-D. IFRS 9 contains an option to designate at initial recognition a financial asset as measured at FVTPL if doing so eliminates or significantly reduces an accounting mismatch that would otherwise arise from measuring assets or liabilities or recognising the gains and losses on them on different bases. On the other hand IFRS 9 establishes a new approach for loans and receivables.

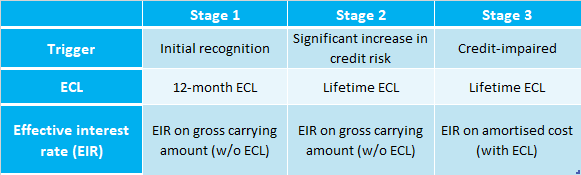

The standard introduces principle-based requirements for the classification of financial assets using the following four measurement categories. Roll rate matrix Provisioning matrix Situation Proposed Approach Trade receivables and contract assets of one year or less or thosewithouta significant financing component. IFRS 9 will replace the requirements for classification and measurement of financial instruments under IAS 39.

Although IFRS 9 requires all equity instruments to be measured at fair value it acknowledges that in limited circumstances cost may be an appropriate estimate of fair value for unquoted equity instruments. Elimination of the held to maturity loans and. Classification of financial liabilities.

EFRAG has previously argued that recycling enhances the relevance of the financial information provided to users of financial statements. IFRS 9 replaces IAS 39s patchwork of arbitrary bright line tests accommodations. IFRS 9 secara keseluruhan berlaku efektif mulai 1 Januari 2018 Khusus untuk industri asuransi IASB sedang mempertimbangkan tanggal efektif IFRS 9 ditunda sampai 2021.

In respect of financial liabilities all IAS 39 requirements have been carried forward to IFRS 9. IFRS 9 Full derecognition of financial assets is the ending point after having decided in Step 5 of the below decision tree that the entity has transferred substantially all risks and rewards for the asset. Any Gain or losses are reported through Income Statement PL or Other Comprehensive Income OCI.

This has resulted in. Loans and receivables including short-term trade receivables. Most of the gains or losses go through PL except below - cash flow hed.

Paragraphs IFRS 9562-7 and IFRS 9B561-2 provide guidance on accounting for reclassifications between specific categories and Example 15 accompanying IFRS 9 illustrates them. IFRS 9 Full derecognition of financial assets. IFRS 9 introduces a new model for classifying financial assets.

IFRS 9 provisioning for receivables IFRS 9 includes the following simplifications for impairment of trade receivables contract assets and lease receivables. FVOCI under IFRS 9 gainslosses of equity instruments are never recycled to PL changes in the fair value of the hedging instrument are also recorded in OCI without recycling to PL. It is a significant improvement not to have recycling under IFRS 9 but we dont think the continued use of OCI is useful.

Ifrs 9 Financial Instruments Gavin Aspden Fca Director

Classification Of Financial Assets Liabilities Ifrs 9 Ifrscommunity Com

Classification Of Financial Assets Liabilities Ifrs 9 Ifrscommunity Com

Financial Assets Under Ifrs 9 The Basis For Classification Has Changed Bdo Australia

Ifrs 9 Finanzinstrumente Institut Fur Rechnungslegung

What Is A Financial Instrument Acca Qualification Students Acca Global

Ifrs 9 Financial Instruments Gavin Aspden Fca Director

Ifrs 9 Overview For All Accountants

Ifrs 9 Financial Asset Classification Annual Reporting

Impairment Of Financial Assets Ifrs 9 Ifrscommunity Com

Posting Komentar untuk "Ifrs 9 Recycling"